Or call us at 812-667-5101

All Business Checking Accounts Include:

Find the Right Checking Account for Your Business

Most Popular

Most Popular: A hassle-free way to manage your business without worrying about fees.

Deposit to Open: $1

Business Elite Checking

Includes Accounting

Includes Accounting: That combines interest earnings with built-in tools to organize business finances.

Deposit to Open: $0

Monthly Service Charge: $30

Includes integrated Accounting, Reporting, and Cashflow Analysis through Autobooks.

Business Premier Advantage

Earns Interest

Earns Interest

Earns Interest: This account earns interest and includes extra perks for your employees. Rates

Deposit to Open: $1500

Monthly Service Charge: $15

or $10.00 if a $10,000 average daily balance is maintained.

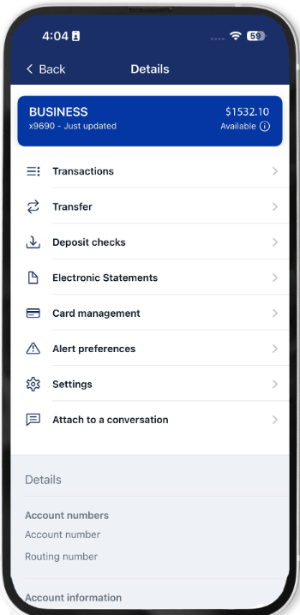

Business Digital Banking Features

Business Digital Banking Features